Trend Following Trading Strategy Using an Automated Bot like LakshmiFX

Introduction

Trend following is a widely used trading strategy that aims to capture sustained market movements in a particular direction. By leveraging an automated bot like LakshmiFX, traders can systematically enter and exit trades based on trend signals, reducing emotional biases and improving efficiency. In this article, we will explore how the trend following strategy works, its implementation using LakshmiFX, and the pros and cons of automated trend trading.

What is Trend Following?

Trend following is a strategy that seeks to capitalize on established market trends, whether bullish (uptrend) or bearish (downtrend). Traders using this approach assume that an asset’s price will continue moving in the same direction rather than reversing. The strategy often relies on technical indicators such as moving averages, trendlines, and momentum oscillators.

How an Automated Bot like LakshmiFX Executes Trend Following

LakshmiFX is an automated trading bot designed to follow trends by using a combination of technical indicators and predefined rules. Here’s how it typically operates:

Trend Identification – The bot analyzes the market using moving averages, ADX (Average Directional Index), or MACD (Moving Average Convergence Divergence) to detect strong trends.

Entry Signal Generation – Once a trend is identified, the bot opens a position in the direction of the trend. This could be a breakout above resistance (buy) or a breakdown below support (sell).

Risk Management – The bot sets stop-loss and take-profit levels to manage risk effectively.

Trade Monitoring – LakshmiFX continuously monitors market conditions and may adjust stop-loss levels or exit trades early if a trend weakens.

Exit Strategy – The bot closes trades when the trend loses momentum or when a reversal signal is detected.

Advantages of Using LakshmiFX for Trend Following

1. Eliminates Emotional Trading

Since trades are executed based on predefined rules, LakshmiFX removes emotional decision-making, reducing impulsive trading mistakes.

2. 24/7 Market Monitoring

Unlike human traders, automated bots can analyze the market and execute trades around the clock, ensuring no trend opportunities are missed.

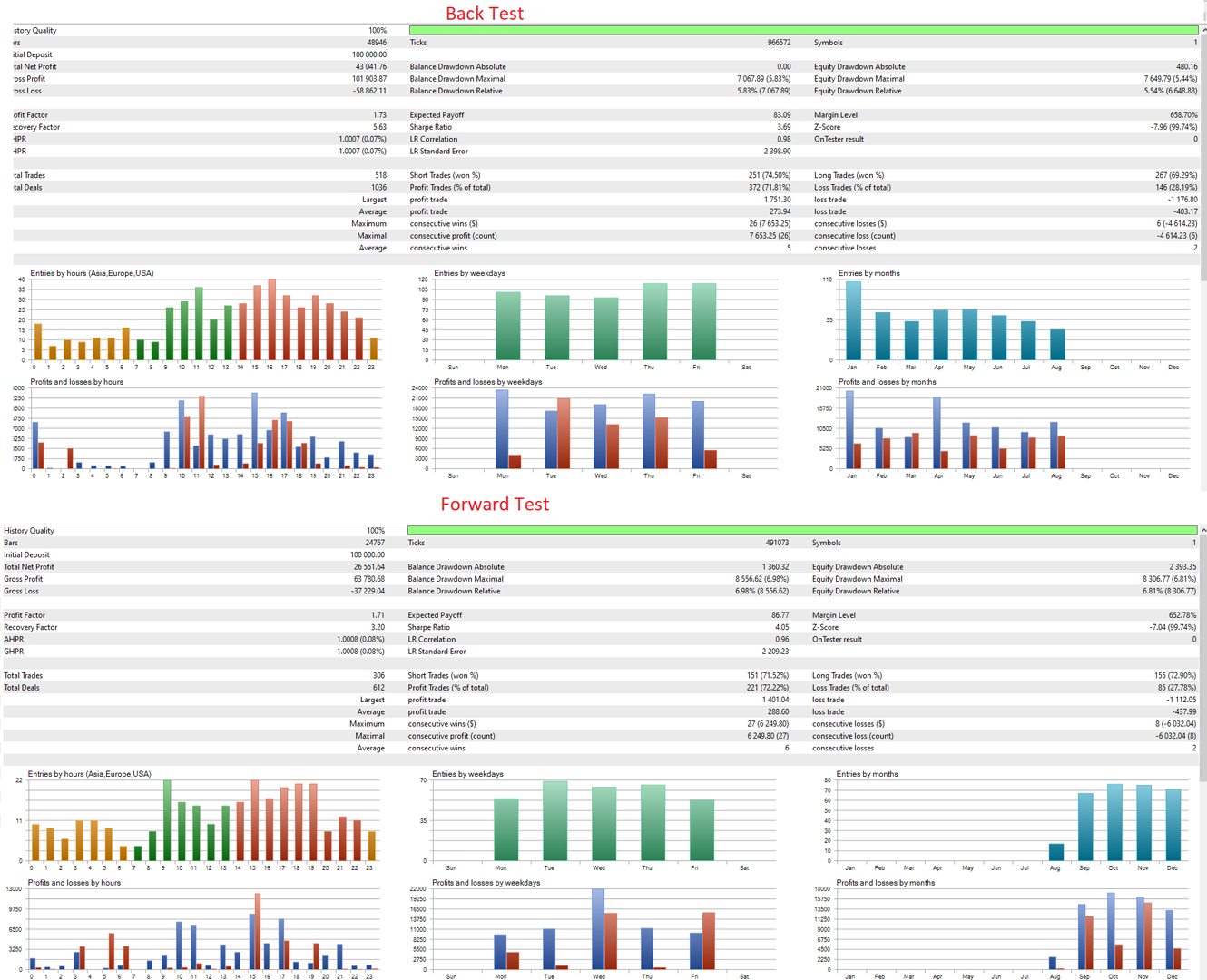

3. Backtesting and Optimization

LakshmiFX allows traders to backtest their trend-following strategy on historical data, helping refine settings for optimal performance.

4. Improved Execution Speed

Automation ensures trades are executed instantly when conditions are met, minimizing slippage and ensuring efficiency.

5. Consistency in Trading

The bot follows the strategy consistently without deviation, reducing the risk of trading errors due to fatigue or overconfidence.

Disadvantages of Using LakshmiFX for Trend Following

1. False Signals in Choppy Markets

Trend following strategies struggle in sideways or ranging markets, leading to potential false breakouts and frequent stop-outs.

2. Requires Proper Optimization

An improperly configured bot may perform poorly or fail to adapt to changing market conditions.

3. Over-Reliance on Historical Data

Backtested results do not guarantee future success, as market conditions evolve over time.

4. Risk of Large Drawdowns

Since trend following does not predict reversals, traders might experience extended periods of drawdowns before profitable trends emerge.

5. Dependence on Broker Execution Speed

Latency and slippage issues with the broker’s execution can impact the effectiveness of automated trades.

Best Practices for Using LakshmiFX in Trend Following

Use Multiple Timeframes – Confirm trends using different timeframes (e.g., daily and hourly charts) to improve accuracy.

Combine with Risk Management – Set proper stop-loss levels and avoid overleveraging.

Regularly Update Bot Settings – Optimize settings based on changing market conditions.

Diversify Across Assets – Apply the strategy to multiple currency pairs or assets to spread risk.

Monitor Performance – Regularly review performance metrics and adjust parameters accordingly.

Conclusion

Trend following using an automated bot like LakshmiFX can be an effective way to capitalize on long-term market movements while reducing human trading errors. However, traders must be aware of its limitations, particularly in ranging markets. By combining proper risk management and optimization techniques, traders can enhance their success with automated trend trading.

WordPress Meta Description

“Learn how to implement a trend-following trading strategy using an automated bot like LakshmiFX. Discover the pros and cons, risk management tips, and best practices to improve your automated trading results.”